The financial services world doesn’t stand still, and neither should your loan processing. Behind every approved mortgage or business loan is a person waiting to move forward with their dreams — but outdated processing systems often keep them waiting.

When loan officers spend more time wrestling with paperwork than helping customers, something needs to change. Your team’s expertise should be spent on making sound lending decisions, not hunting down missing documents or manually transferring data between systems. The right automation tools transform overwhelming stacks of applications into manageable workflows.

By streamlining these critical processes, lenders can cut response times significantly while improving accuracy. Your customers will notice the difference — and so will your bottom line.

Loan processing workflow definition

A loan processing workflow is simply the series of steps that happen from when someone applies for a loan until they either receive the money or get denied.

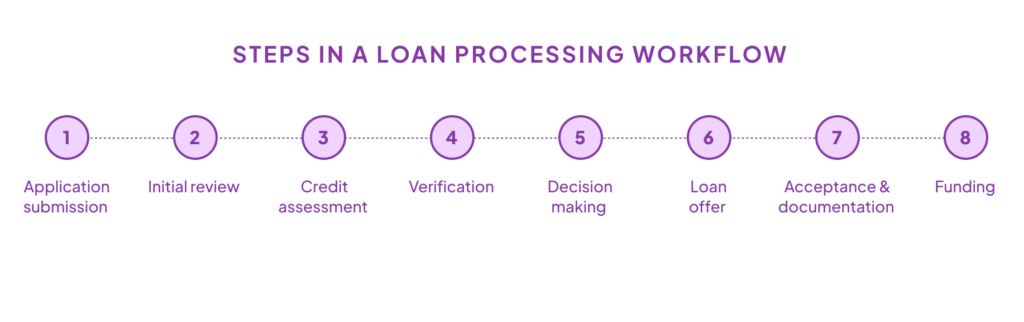

In basic terms, a loan processing workflow typically involves:

- Application submission: The borrower fills out forms with personal information, financial details, and the loan purpose.

- Initial review: The lender checks if the application is complete and meets basic requirements.

- Credit assessment: The lender evaluates the borrower’s credit score, income, and existing debts to determine their ability to repay.

- Verification: The lender confirms the information provided, such as employment, income, and assets.

- Decision making: Based on the assessment, the lender decides whether to approve or deny the loan.

- Loan offer: If approved, the lender presents the loan terms, including interest rate and repayment schedule.

- Acceptance and documentation: The borrower reviews and signs the loan agreement.

- Funding: The money is transferred to the borrower.

This process helps lenders manage risk while providing borrowers access to funds, though the exact steps and complexity can vary depending on the loan type (mortgage, personal loan, business loan, etc.) and the financial institution.

Why automate loan processing workflows?

Automating loan processing workflows significantly improves the efficiency and accuracy of any financial institution. Automation enables banks and lending companies to streamline their operations, resulting in faster turnaround times for loan applications. This means borrowers receive timely responses, enhancing customer satisfaction and loyalty.

One of the primary advantages of automating loan processing workflows is the reduction of manual errors. Traditional processing methods often rely heavily on human input, leading to mistakes that delay approvals or create compliance issues. Automated systems minimize these risks by standardizing processes and ensuring all necessary checks and balances are in place. This results in a higher level of accuracy in data handling and reduces the likelihood of costly errors.

Additionally, automation significantly cuts down processing time. When they automate routine tasks such as document verification, data entry, and communication with borrowers seamlessly, lending institutions can focus their human resources on more complex aspects of loan processing. This improves operational efficiency and allows teams to build stronger client relationships.

| Problems | Solutions |

|---|---|

| Manual Errors | Automated Error Checking |

| Slow Processing Times | Accelerated Workflows |

| Compliance Issues | Built-in Compliance Features |

| Data Security Risks | Robust Security Protocols |

| Poor Customer Experience | Real-time Updates and Transparency |

Key elements for optimizing loan processing

- Automated workflow: A well-structured loan processing workflow reduces bottlenecks and accelerates application approvals, allowing lenders to respond more quickly to borrower needs. Process automation tools enable organizations to streamline repetitive tasks, freeing staff to focus on more complex issues that require human intervention.

- Integration: Integrating data sources and systems is another fundamental aspect of optimizing loan processing. When various platforms, such as CRM systems, loan origination tools, and credit bureaus, communicate seamlessly, it enables real-time data access and improves decision-making. This integration enhances the accuracy of the information processed and provides a comprehensive view of the borrower’s profile, which is vital for risk assessment.

- Security and compliance: Ensuring compliance and security in loan processing is imperative for protecting sensitive customer information and adhering to regulatory requirements. Implementing robust security measures, such as encryption and access controls, safeguards data integrity while promoting confidence among borrowers. Maintaining compliance with industry regulations helps mitigate legal risks and fosters trust in financial institutions. Advanced workflow solutions support these efforts by automating compliance checks and maintaining auditable records, ensuring a secure loan processing environment.

Loan processing automation for seamless client lending

Enhancing the client experience is the key to success at any financial institution. Automated loan processing workflows play a crucial role in this by streamlining operations and improving customer interactions. By integrating intelligent workflows, lenders can reduce the time taken to approve loans, ensuring clients receive timely responses and a seamless application experience.

Streamlining loan origination and modifications not only speeds up the overall process but also minimizes the risk of errors. With a robust loan processing workflow, lenders can automate repetitive tasks such as document collection and verification so their teams can focus on delivering exceptional service. This efficiency translates into quicker decisions and a more pleasant experience for clients, ultimately fostering long-term relationships.

Plus, increasing transparency and accountability throughout the loan processing journey is vital for building trust with clients. Automated workflows provide real-time updates on application status, ensuring clients are informed every step of the way. This transparency not only improves client satisfaction but also reinforces the institution’s credibility. With a clear view of the loan process, clients are more likely to engage with the lender, knowing they are part of a well-managed system.

Accelerate loan processing processes

Automation streamlines repetitive tasks, reduces manual errors, and improves overall efficiency. By implementing automated workflows, you can significantly reduce the time required to process loan applications, so you can meet customer expectations swiftly and effectively.

Streamlining document management and approval processes is another vital aspect of accelerating loan processing. With advanced document management systems, all necessary documents can be easily organized, tracked, and retrieved. Automated approval workflows ensure that each application progresses smoothly through the required stages, with notifications and reminders prompting team members to act promptly. This not only speeds up the approval process but also enhances compliance with regulatory standards.

Improving collaboration between loan processing teams is crucial for a seamless workflow. When teams can communicate effectively and share critical information in real time, the chances of delays decrease significantly. Automated solutions facilitate better collaboration by providing a centralized platform where team members can access documents, track progress, and exchange feedback. This cohesive approach not only fosters teamwork but also results in a faster, more efficient loan processing experience for both the institution and its customers.

Maximize efficiency with automated loan management systems

Implementing an automated loan management system can significantly improve the efficiency of your loan processing workflow. By streamlining tasks like application processing, document management, and compliance checks, loan processing automation systems reduce manual errors and accelerate turnaround times. Additionally, automation allows for better tracking of loan statuses and enhances communication with borrowers, leading to improved customer satisfaction.

Because loan management comes with its own set of challenges, including regulatory compliance, data security, and integration with existing systems, it’s important to look for a loan management solution that can address these challenges with built-in compliance features, robust security protocols, and seamless integration capabilities.

When choosing the right loan management software, you should also assess your institution’s specific needs. Consider factors such as scalability, user-friendliness, and the ability to customize workflows. The right loan management system should not only fit your current requirements but also be adaptable to future changes in your business. By selecting a solution that aligns with your goals, you can ensure a smoother loan processing experience and ultimately drive business growth.

FAQs

What is a loan processing workflow?

A loan processing workflow is a sequence of steps that financial institutions follow to review, approve, and fund loan applications. It includes tasks such as document collection, verification, underwriting, and approval.

How does automation improve loan processing?

Automation improves loan processing by reducing manual tasks, minimizing errors, accelerating processing times, and ensuring compliance with regulatory standards. This leads to increased efficiency and better customer satisfaction.

Can automated loan processing be customized?

Yes, automated loan processing systems can be customized to fit the specific needs of financial institutions. No-code workflows allow organizations to design processes that meet their unique requirements without extensive programming knowledge.

What are the security measures for automated loan processing?

Automated loan processing systems implement robust security measures such as encryption, access controls, and compliance checks to protect sensitive customer information and ensure data integrity.

Learn more about automating financial services with Nintex

Automation leads to faster decisions and keeps your data accurate with fewer repetitive tasks. Deliver experiences that put you on top – with your business and your customers.