Running any size organization today means juggling countless financial tasks that can quickly take up your team’s time and energy. That’s where financial automation becomes a real game-changer. Think of it as having a reliable assistant that handles the repetitive stuff — sending invoices, tracking expenses, and generating reports — so your people can focus on what really matters.

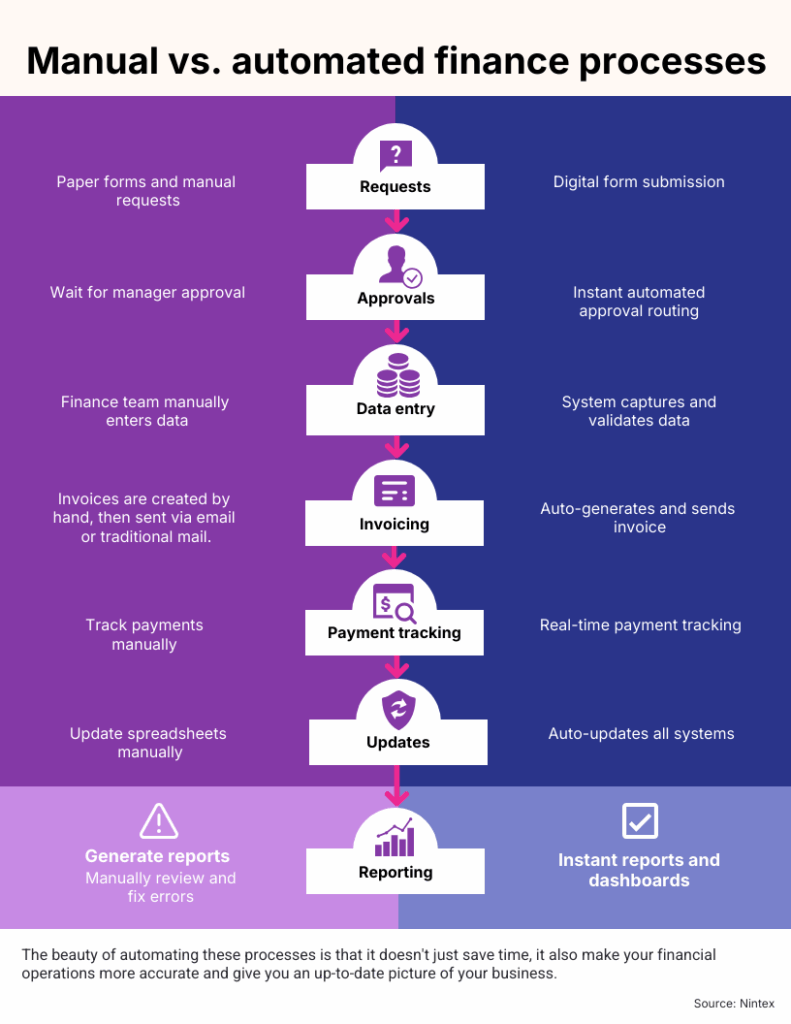

The beauty of automating these finance processes is that it doesn’t just save time. It actually makes your financial operations more accurate and gives you a clearer picture of how your business is doing right now, not weeks later when someone finally gets around to updating the spreadsheets. For companies looking to grow and stay ahead of the competition, embracing financial automation isn’t just smart — it’s becoming essential.

Definition of financial automation

Financial automation involves using technology to streamline and improve financial operations, thereby reducing manual tasks and increasing efficiency. It includes a range of automated tools and systems designed to manage activities such as invoicing, budgeting, reporting, and reconciliation. By automating financial processes, organizations can significantly improve accuracy and reduce the time spent on routine financial activities.

Key components of financial automation include software solutions for accounts payable, accounts receivable, enterprise resource planning (ERP) systems, and data analytics tools. These technologies work together to facilitate seamless data integration, real-time reporting, and improved compliance. Through features like automated workflows and electronic approvals, finance automation software helps businesses maintain better control over their financial processes.

The primary distinction between financial automation and manual processes lies in the level of human intervention required. Manual processes often involve repetitive tasks that are prone to errors and inefficiencies, whereas automation in finance minimizes human involvement by using intelligent systems to handle these tasks. This not only accelerates the overall financial workflow but also allows finance teams to focus on strategic decision-making rather than being bogged down by administrative duties.

Which financial processes should be automated?

Key Processes Suitable for Financial Automation

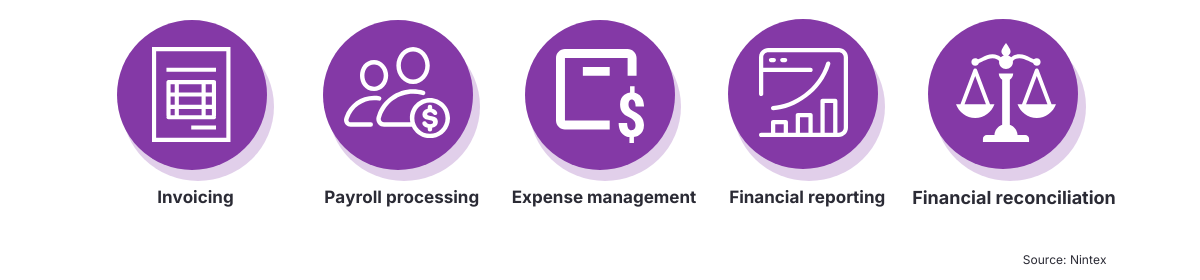

Finance process automation has become a pivotal strategy for businesses looking to improve efficiency and accuracy in their operations. Common financial tasks that are ideal for automation include invoicing, payroll processing, expense management, and financial reporting. By automating these repetitive tasks, organizations can reduce human error, save time, and free up valuable resources to focus on strategic initiatives.

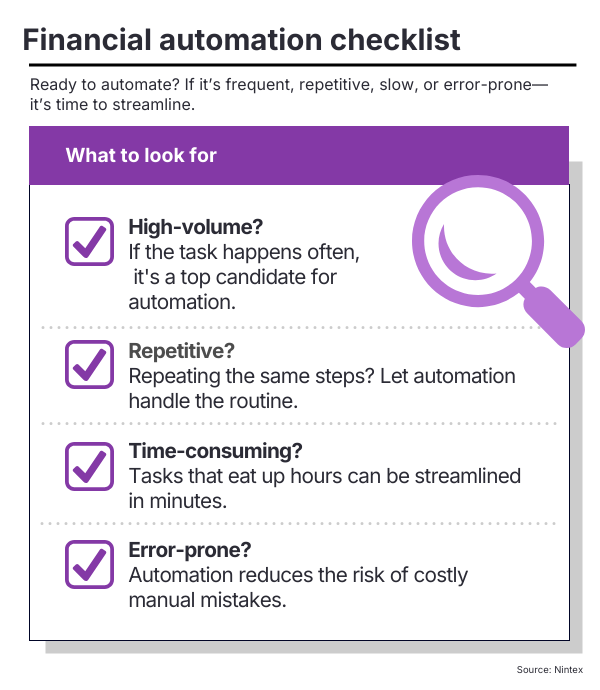

When selecting processes for automation, it is essential to evaluate several criteria. Look for tasks that are high-volume, repetitive, and prone to errors when performed manually.

Additionally, consider the complexity of the task and the potential return on investment (ROI) from automating it. Prioritizing processes that require significant time and personnel can yield substantial benefits, both in terms of efficiency and cost savings.

Numerous organizations have successfully implemented financial automation, leading to improved accuracy and faster processing times. With the right approach and tools, automating financial processes can transform how businesses manage their finances, driving growth and productivity.

How does financial automation solve your invoicing challenges?

| Problems | Solutions |

| High rate of manual errors → | Automated error-checking systems |

| Time-consuming processes → | Streamlined workflows |

| Delayed payments → | Faster processing times |

| Lack of visibility into invoice status → | Real-time tracking and reporting |

| Manual data entry inefficiencies → | Elimination of manual data entry |

Benefits of Financial Automation

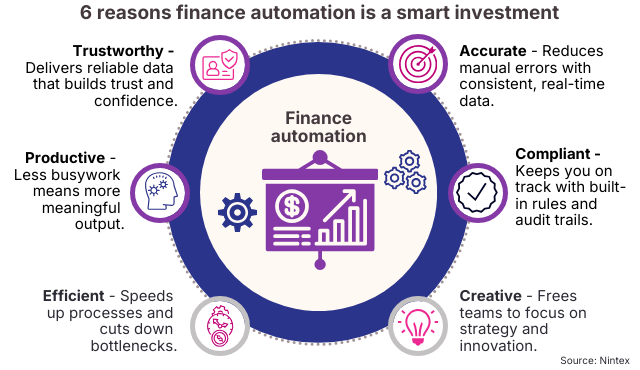

Financial automation is changing the way organizations manage their financial processes, leading to significant cost savings and efficiency improvements. By automating routine tasks such as invoicing, expense management, and reporting, businesses can streamline their workflows, reduce manual errors, and free up valuable time for their finance teams. This efficiency not only lowers operational costs but also allows organizations to allocate resources more effectively, improving overall productivity.

Moreover, financial automation enhances accuracy and compliance. Automated systems minimize the risk of human error, ensuring that financial data is consistently accurate and up-to-date. With built-in compliance checks and real-time reporting capabilities, organizations can easily adhere to regulatory requirements, reducing the risk of costly fines and penalties. This level of precision is crucial for maintaining trust with stakeholders and ensuring the integrity of financial reporting.

The impact of financial automation extends beyond cost and compliance; it also significantly boosts team productivity and job satisfaction. By eliminating tedious manual tasks, employees can focus on more strategic activities that require critical thinking and creativity. This shift not only leads to higher job satisfaction but also encourages professional development, as team members can engage in more fulfilling work. Ultimately, finance automation fosters a more motivated workforce, paving the way for innovation and growth within the organization.

Challenges in Implementing Financial Automation

Implementing financial automation can present several common obstacles that organizations must navigate to achieve successful deployment. One of the primary challenges is resistance to change among employees. Many team members may feel apprehensive about adopting new technologies, fearing that their roles could be diminished or altered significantly. This necessitates a robust change management strategy that includes effective communication and engagement with staff to highlight the benefits of financial automation.

Alongside change management, comprehensive employee training is crucial. Providing adequate training ensures that staff are equipped with the necessary skills to use new finance automation software effectively. Without proper training, the risk of mistakes increases, potentially leading to costly errors and decreased productivity.

Technical challenges and integration issues also pose significant hurdles. Organizations often rely on various legacy systems, making it difficult to integrate new automation solutions seamlessly. Ensuring compatibility between existing infrastructure and new financial automation software is essential to avoid disruptions in operations. Additionally, organizations must consider data migration processes and the potential need for ongoing technical support to ensure that the financial automation implementation is sustainable in the long run.

Best Practices for Financial Automation

Implementing financial automation successfully requires a systematic approach. Begin by clearly defining your objectives and identifying the specific processes that can benefit from automation. Engage stakeholders from various departments to gain insights and foster collaboration. Next, choose the right automation tools that align with your business needs. After selecting the tools, develop a detailed implementation plan that includes timelines, training, and user adoption strategies.

Data security and privacy are paramount in financial automation. Ensure that your automation tools comply with relevant regulations and standards, such as GDPR or HIPAA. Implement robust security measures, including encryption and access controls, to protect sensitive financial data. Regularly audit your systems to identify vulnerabilities and enhance security protocols as needed.

Continuous monitoring and improvement are vital for maintaining the effectiveness of your financial automation. Establish key performance indicators (KPIs) to measure the success of automated processes. Regularly review performance data and seek feedback from users to identify areas for enhancement. Utilizing analytics features can help in assessing the efficiency of your financial operations, allowing you to make data-driven decisions that further optimize your automation strategy.

The Future of Financial Automation

The landscape of financial automation is rapidly evolving, influenced by several key trends that are reshaping how businesses manage their financial processes. One of the most significant trends is the growing demand for real-time data analytics. Companies are increasingly focusing on harnessing data to drive decision-making, improve efficiency, and enhance customer experiences. This shift is paving the way for more automated solutions that provide insights instantaneously, allowing finance teams to respond swiftly to market changes.

Artificial intelligence (AI) and machine learning (ML) are playing a crucial role in this transformation. These technologies enable financial automation systems to learn from historical data, predict trends, and automate complex tasks with greater accuracy. By integrating AI and ML, organizations can streamline workflows, reduce human error, and improve compliance by automating repetitive tasks such as invoice processing and transaction monitoring. This not only increases operational efficiency but also allows finance professionals to focus on strategic initiatives that add value to the business.

However, the rise of financial automation also has implications for the workforce. As automation takes over routine tasks, there is a growing need for finance professionals to adapt to new roles that require analytical skills and a deeper understanding of technology. While some jobs may be displaced, many new opportunities will emerge in areas like data analysis, financial strategy, and systems management. The key for finance teams will be to embrace this change, upskill, and leverage automation tools to enhance their roles in the evolving financial landscape.

FAQs About Financial Automation

What is financial automation?

Financial automation refers to the use of technology to automate repetitive financial tasks such as invoicing, expense management, and reporting, reducing manual intervention and increasing efficiency.

What are the benefits of financial automation?

Financial automation offers numerous benefits, including improved accuracy, reduced manual errors, faster processing times, enhanced compliance, and significant cost savings.

What tasks can be automated in financial processes?

Common tasks suitable for automation include invoicing, payroll processing, expense management, financial reporting, and reconciliation.

What challenges might organizations face when implementing financial automation?

Organizations may encounter resistance to change, technical integration issues, and the need for comprehensive employee training when implementing financial automation.

How does financial automation impact the workforce?

While some routine tasks may be automated, new opportunities will emerge in areas like data analysis and financial strategy, requiring finance professionals to adapt to new roles.